Taking out a mortgage is a big financial commitment, so it helps to know a little more about what’s on offer, what your options are, and how the process works.

Finding the right deal is important. Whether you’re new to the mortgage market, or you’ve had a mortgage for a while but are considering a move, this guide sets out a few facts and gives important information to help you make the right choices.

We’ll also explain how we can help you successfully navigate the mortgage market and ensure you get the right deal for your financial circumstances.

A mortgage is a loan made by a bank or building society to enable you to buy a house or other type of property. The length of the mortgage will usually be anything up to 40 years for a standard repayment mortgage. The shorter the term, the more you will repay each month, but you will obviously pay off the mortgage more quickly and pay less in interest on the term of the loan. When you sign the mortgage agreement, you are agreeing to give the property as security for the loan.

The amount you borrow is referred to as the capital sum. The lender then charges you interest on the amount you have borrowed.

When it comes to monthly repayments, these can be interest and capital, referred to as a repayment mortgage, or just interest, referred to as an interest-only mortgage. In addition, some lenders offer mortgages on a part-repayment and part interest-only basis.

Each month, you pay back part of the mortgage capital and the monthly interest. At the outset, most of your monthly payment will be interest; later on, more of your monthly payment will be repaying the capital. At the end of your mortgage term, you will have paid off the entire loan plus the interest.

Here, each month you only pay the interest outstanding on the loan, meaning that the capital sum remains the same throughout the term of the mortgage. These mortgages are not as widely available as they once were. Lenders will now only lend money in this way if the borrower can clearly demonstrate how they propose to repay the capital sum at the end of the mortgage term.

As the name suggests, this type of mortgage is a combination of a repayment and an interest-only mortgage as outlined above. With this type of mortgage, as with an interest-only mortgage, at the end of the mortgage term, some of the mortgage capital will still be owed and you will need to have a plan in place to repay it.

Before you start arranging property viewings, the big question is always “How much can I borrow?” In the past, the answer to this would have been a rule-of-thumb multiple based on your salary, or your joint salaries if you were buying with someone else.

Post credit crunch and the financial crisis, mortgage lenders were required by the Financial Conduct Authority (the regulator of the financial services industry), to adopt an affordability based approach to lending. This means that banks and building societies are now required to scrutinise borrowers’ incomes, outgoings and credit history closely and apply strict affordability criteria, ensuring that borrowers can comfortably afford their repayments now, and in the foreseeable future.

This is where your mortgage adviser fits in. Although lenders are all bound by the same general principles and criteria, there are slight variations in the way they apply them. So it really pays to work with a mortgage adviser. Their knowledge of the market and understanding of the approach adopted by individual lenders means they can help you present your application in a positive light, to the right lender, saving you time and stress.

The bigger the deposit, the better the deal

Having a large deposit really matters in the current market. Typically the more you can put down, the lower the interest rate you are likely to be offered.

While lenders may be prepared to lend purchasers up to 95% of the property price, with the borrower putting in the remaining 5% as a deposit, better deals and rates are available to those who can put down, say, 20% or even more.

If you’re thinking of remortgaging, and the equity in your property (the difference between the value of your property and the amount of mortgage you have left to repay) has increased, then you can use it as a larger deposit and secure a lower mortgage rate.

This is where our adviser’s knowledge of the marketplace really helps. They will be able to provide examples that illustrate what you’d pay, depending on how much deposit you’re able to provide.

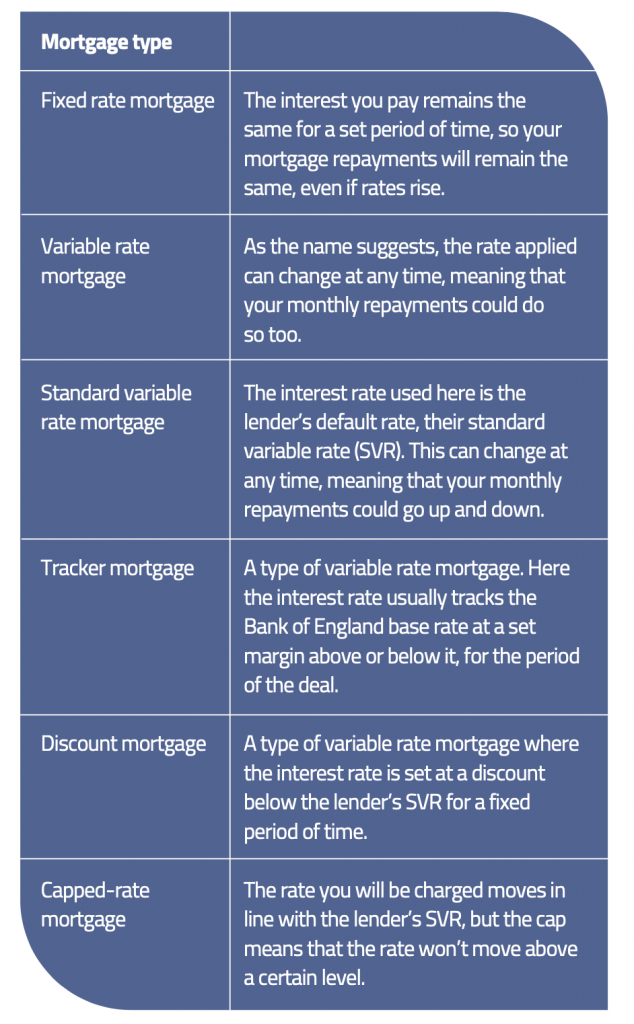

Mortgages come in all shapes and sizes, and from time to time, lenders offer borrowers a range of added extras.

A Free Valuation

Some lenders offer a fee-free standard valuation carried out by their chosen surveyor as part of their mortgage deal. This could save around £200 in upfront costs when purchasing a property. These deals are often available both to purchasers and those remortgaging their property.

As an alternative to free valuations, some lenders will charge the valuation fee upfront, but will then refund the fee in full on completion. Furthermore, certain lenders will refund your valuation fee if for any reason your house purchase falls through, and you go on to purchase another property with a mortgage from the same lender.

“Each year we help many people across the UK find the most cost-effective and appropriate mortgage deal for their individual financial circumstances, so you’ll find us knowledgeable, approachable and friendly to deal with.”

Cashback

This type of mortgage arrangement means that you receive a cash sum once your purchase has been completed and your mortgage is in place. This incentive sometimes requires the borrower to have a current or savings account with the lender. The amount you receive is normally expressed as a percentage of the amount you have borrowed and is designed to help out with costs associated with moving house.

Free conveyancing

Here, the lender will choose the conveyancer on your behalf and pay the basic legal fee to those who are remortgaging their existing property. This incentive can also be offered by some lenders to those who are purchasing a property.

Mortgages with special offers attached may not always represent the best deals on the market; your mortgage adviser will be

able to help you choose the most appropriate deal for your financial circumstances.

Lenders secure your mortgage against your property through a legal charge, so if you fall behind with payments and no other solution can be found, then the lender can repossess your home.

If you get into arrears or find it a strain to keep up with your monthly payments, you should seek advice as soon as possible. Your adviser may be able to find you a mortgage deal that is more affordable, perhaps with a lower interest rate or one that can be repaid over a longer period of time.

YOUR HOME/PROPERTY MAY BE REPOSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

There will be a fee for our services, the exact amount will depend on your circumstances and precise details will be given to you on initial enquiry and you will not be expected to proceed until you have had the fee details in writing and have agreed the fee amount.

The Financial Conduct Authority does not regulate some forms of buy to lets, commercial mortgages, secured loans, unsecured loans, bridging loans, trusts, overseas mortgages, and conveyancing or debt management.

The guidance and/or information contained within this website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK

James Anthony Aubrey trading as JA Financial Services appointed representative of HL Partnership Limited, which is authorised and regulated by the Financial Conduct Authority

Part of the HLPartnership Mortgage & Protection Network